Why use our Hodl Index algorithm

Choose from several strategies

The choice of strategy is yours. Whether you opt for the strongest cryptocurrencies or lower profile but powerful ones. We will help you choose.

You are the owner of the cryptocurrencies

From the beginning of the investment into our Hodl Index, the cryptocurrencies you have purchased in your chosen portfolio are yours and you are their direct and sole owner.

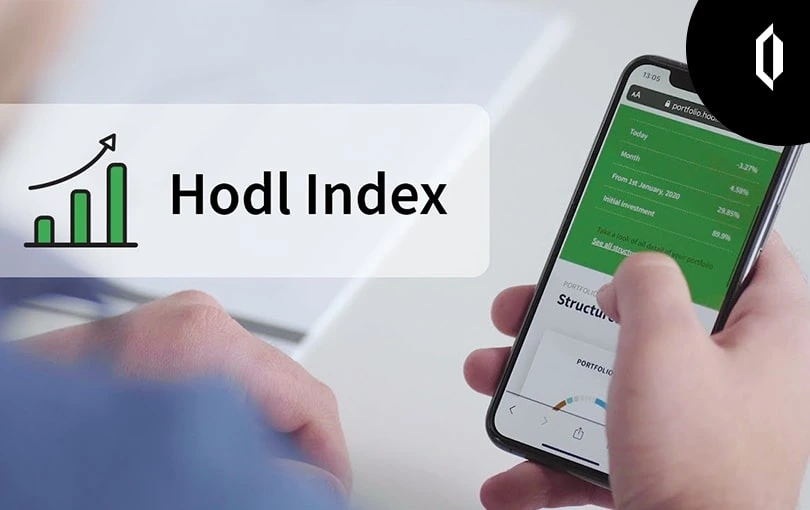

Monitoring graph performance in real time

You can monitor the development of cryptocurrencies in real time thanks to our clear system, which, in addition to a graph, also shows your real profit in a given strategy.

Secure offline storage

From the beginning of investing through the Hodl Index, cryptocurrencies become yours. These cryptocurrencies are stored in a safe, so you can rest assured they're secure.

A long-term investment that delivers yields

It takes time for your portfolio to be valued effectively. We recommend three to five years. But of course you can make a choice at any time.

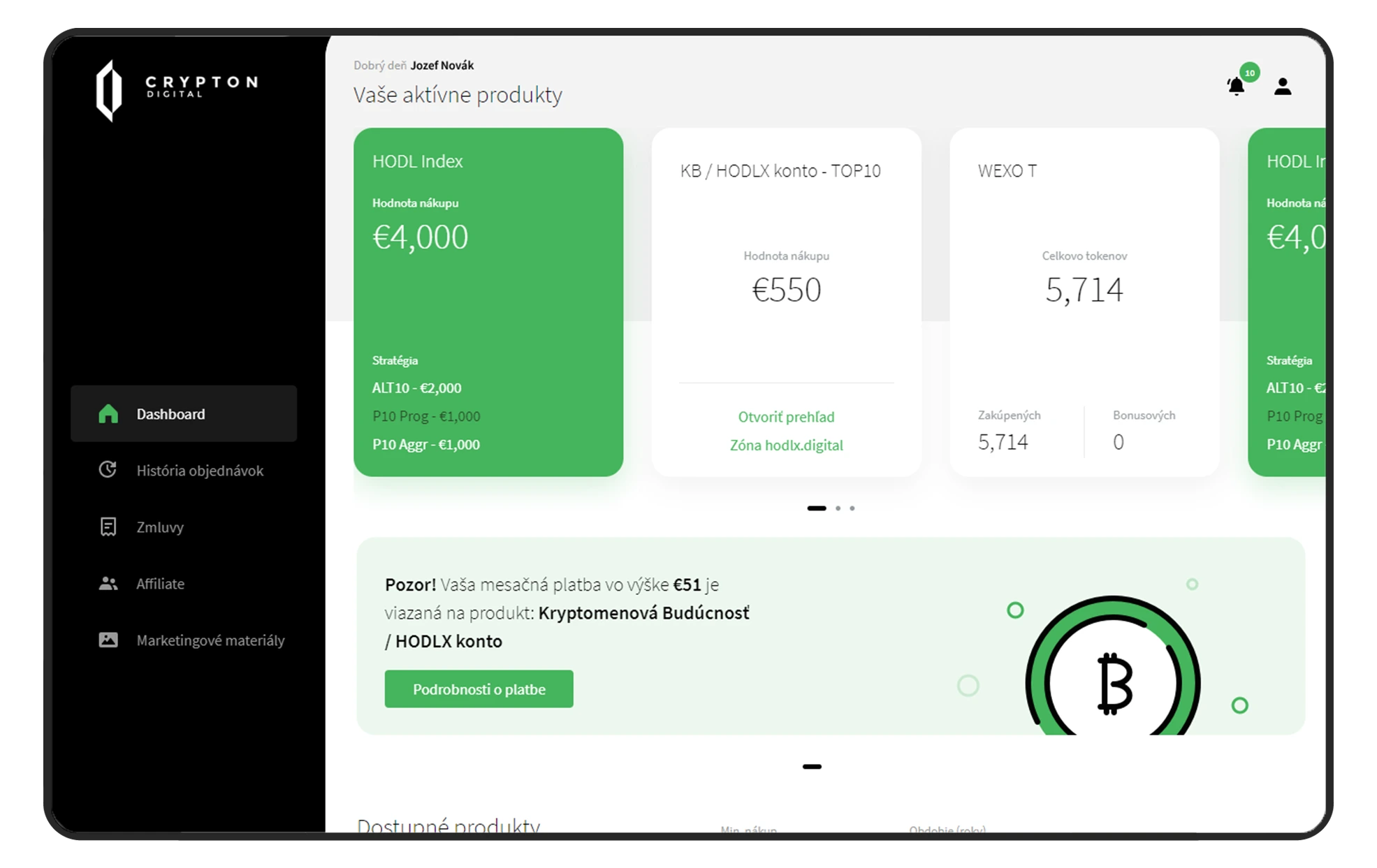

Minimum size and investment period

The minimum investment deposit for the Hodl Index is EUR 1,000, and the minimum investment period is one year. You can withdraw sooner, but with fees.

WE AUTOMATICALLY DIVERSIFY YOUR INVESTMENTS

Our algorithm redistributes your investment in carefully selected high-potential cryptocurrencies. So your return is as high as possible, while the associated risk is reasonable.

What are the strategies and choices?

The cryptocurrency world is moving much faster than standard markets. That's why we have already made six of the original two strategies in our Hodl Index. We have something for everyone - from conservative to more dynamic clients. Some strategies are less risky, but in some cases may also be less profitable. Strategies are also available for risk-takers that include riskier cryptocurrencies, which may ultimately provide a higher yield. You choose which strategy to follow. However, the overriding principle is to spread your bets.

Hodl Index strategy

TOP10

The strategy covers the top 10 best cryptocurrencies, including Bitcoin. This strategy covers cryptocurrencies that altogether hold a capitalisation of more than 80% of the total cryptocurrency market value. The dominant cryptocurrency of this portfolio is Bitcoin.

Risk / Return on investment

Cryptocurrency

Bitcoin

ALT10

The strategy contains the top ten best alternative cryptocurrencies, excluding Bitcoin. The portfolio includes cryptocurrencies whose capitalisation makes up more than 50% of the total cryptocurrency market value.

Risk / Return on investment

Cryptocurrency

Ethereum

Platform10 Progressive

The strategy includes ten crypto-projects that have their own blockchain environment platform. They've established significant development cooperation partnerships for the private, public, banking and government sectors. One such cryptocurrency is Cardano.

Risk / Return on investment

Cryptocurrency

Cardano

Platform10 Aggressive

The strategy includes ten crypto-projects from a blockchain environment hand-picked by the specialised CRYPTON DIGITAL team. These crypto-assets have been on the market for a shorter period of time, yet offer a solution that provides answers to the shortcomings of older projects, or fill previously unexplored space for implementation.

Risk / Return on investment

Cryptocurrency

Polkadot

Crypton10 Balance

The strategy includes ten selected crypto-projects that are among the top one hundred cryptocurrencies ranked by market capitalisation. The majority of these projects have their own history on the market and a strong potential to do well.

Risk / Return on investment

Cryptocurrency

Monero

Crypton10 Dynamic

The strategy includes ten selected crypto-projects that are among the top five hundred cryptocurrencies ranked by market capitalisation. This strategy is considered to be the riskiest one in our portfolio, but it also has the ability to deliver the highest value.

Risk / Return on investment

Cryptocurrency

Bancor

BITCOIN&GOLD

A 50:50 balanced strategy for a crisis period combines the most up-to-date dynamic cryptocurrency market and the stability of centuries-tested gold. The BITCOIN&GOLD portfolio includes a proportional investment in physical gold represented in the form of PAX GOLD and digital gold represented in the form of Bitcoin.

Risk / Return on investment

Cryptocurrency

PAX Gold

SK

SK EN

EN CS

CS HU

HU PL

PL DE

DE